Victoria’s Secret is a popular lingerie brand that deals in women's wear and beauty products. The global fame of the lingerie brand compels it to introduce innovations and comfort for the customers. However, Victoria’s secret credit card is a superb effort to facilitate the regular Victoria’s secret customers.

Introduction

Victoria’s Secret has launched its own branded credit card. The users can use this credit card in Victoria’s stores and affiliated stores including PINK and Baby & Bath. The branded credit card features exclusive offers and promotions. Scrolling down, you can know how Victoria’s Secret credit card works; the benefits and rewards; and how to avail of the services.

How the Victoria’s Secret Credit Card Works: Benefits and Rewards?

Victoria’s Secret Credit Card is a superb opportunity to avail of gifts and rewards. It benefits repeated customers and regular visitors. The cardholders can get benefits by visiting the store in person or visiting the official website of Victoria’s Secret.

Victoria’s Secret Credit Card Rewards

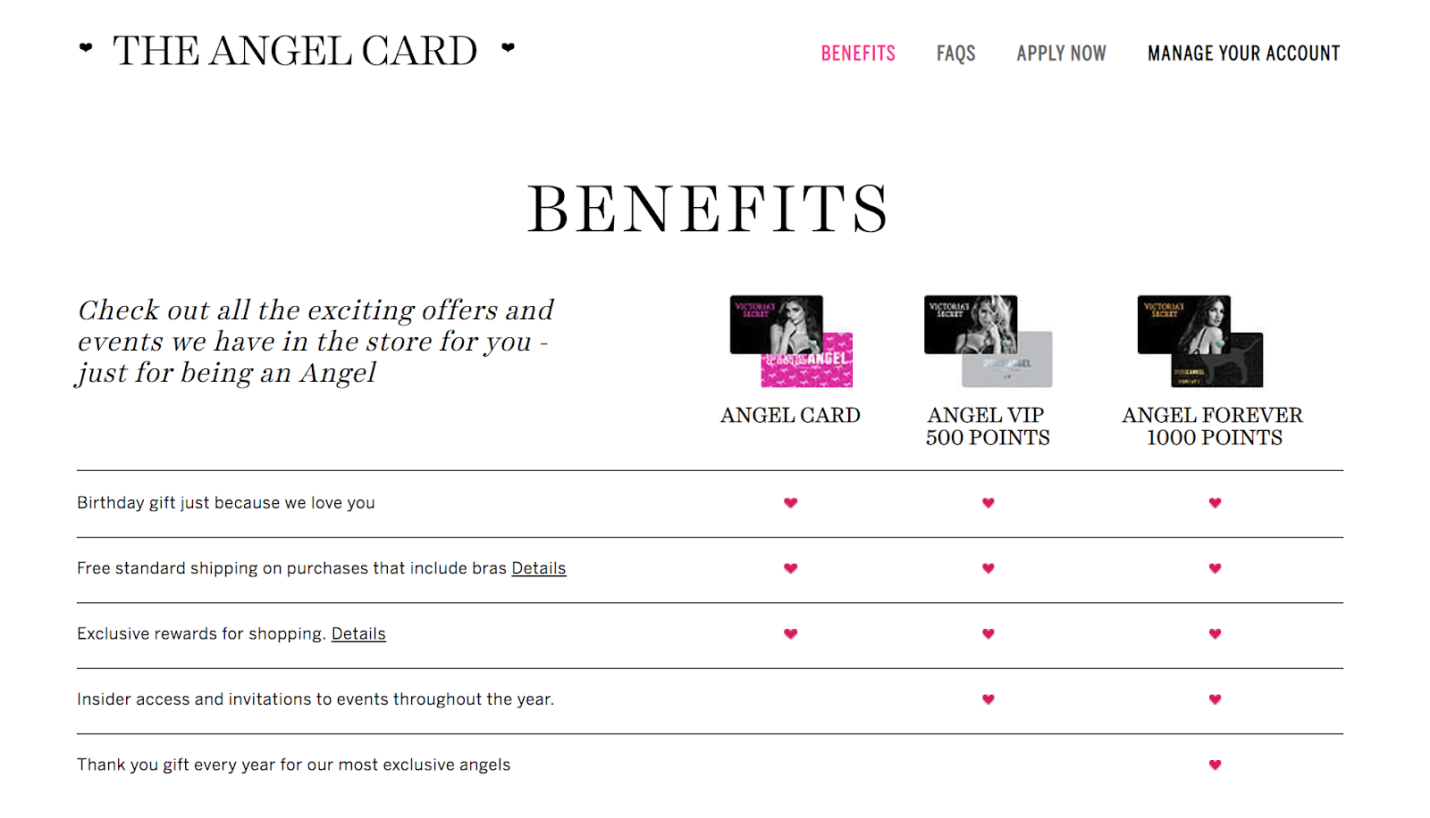

Victoria’s secret credit card reward contains three reward tiers.

- Basic

Basic Victoria card allows the cardholder to earn triple points. The users can qualify for this reward tier by purchasing any type of bra. The cardholders can be eligible for free shipping on above $50 purchases. Additionally, the cardholder also receives a $10 reward on his or her birthday every year. Furthermore, another $10 reward is offered for future purchases.

- Silver

The second reward tier is Victoria’s silver card. The users receive 10 points on every 41 purchases. So, on earning 2000 points, the user can get back $10 rewards. Further, the silver cardholder gets triple points on bras purchases just like the basic tier. The Victoria’s secret basic cardholder can qualify for this reward by spending $250 within 12 months.

- Gold

The Victoria’s Secret Gold credit card gives back a 7.5% reward to the users. On spending $1, the Gold cardholder gets 15 points. It sounds amazing. Like the other two tiers, the Gold cardholder also receives triple points on all bra purchases. However, Victoria’s cardholder can reach the status of Gold tier by spending $500 within 12 months of tenure.

Victoria’s Secret Credit card benefits

Victoria’s Secret Credit card user is not confined to the reward tiers only. Surprisingly, Victoria’s Secret offers several other appealing benefits on just becoming a card member. Here are the top picks:

- First, the card members can get a $25 reward on the first purchase from Victoria’s Secret Credit card.

- Second, Cardholders get free shipping on any purchase from Victoria’s Secret or PINK.

- Next, the card members can get invites, exclusive offers, and promotional deals beforehand.

- Moreover, a Birthday gift is the most appealing benefit for your big day. In addition, Victoria’s cardholder gets the half birthday treat within the half-year period.

- Victoria’s secret credit card society also celebrates the cardholders’ anniversary of sign-up.

How to get a credit card for Victoria’s rewards and benefits?

Victoria’s Secret works in collaboration with the Comenity bank to issue the credit cards. Further, the cardholders can avail of a revolving line of credit from Comenity bank.

A criterion to qualify for Victoria’s Credit Card

If you are confused about how to get a credit card, we have listed all requirements. See below:

- The age of credit card applicants should be 18 years old.

- Only residents of the United States with a national ID card and social security number can apply for the branded credit card.

- The applicant should have a valid mailing address with a contact number and email.

- Comenity bank verifies the consumer’s credit report and evaluates the credit history.

Comenity bank issues Victoria’s credit card for a limited period. The validity date of the card depends upon the consumer’s finance and credit history. Bank evaluates the cardholder’s credit report before extending the credit card.

Victoria’s Secret Credit card- Consumers’ preference

Many top-rated stores issue their brand’s credit cards just like Victoria’s. But Victoria’s Secret has significantly earned fame and excellence through customer care and quality services. Victoria’s secret credit card has become the preference of consumers for several reasons like:

- Free shipping

Online shoppers are often sick of heavy shipping charges. The store’s credit card allows you to get all online purchases with free home delivery. Additionally, if the customers are unable to get any item in stock, the responsible personnel avail it and deliver it to the customer’s home address free of cost. It sounds truly cool.

- Big day surprise

Birthday is a big day for everyone. Victoria’s Secret remembers its consumers and wishes them a surprise gift. Moreover, the cardholders also receive a half birthday treat. It reminds the cardholders that the big day is only a few months away.

- Free-of-hidden annual charges

Unlike competitor stores, Victoria’s secret does not charge any annual charges. However, the cardholder may have to pay for late payments.

- Premium Quality products

You can avail premium quality products at surprising prices using the store’s credit card.

- Quick access to promotions and events

Victoria’s secret let the users peep into upcoming events and celebrations. So, the consumers can get invitations and upcoming promotions ahead of time.

Conclusion

Finally, you might have known how the Victoria’s Secret Credit Card Works: Benefits and Rewards; and how to get a credit card. You can use it at all Victoria’s Secret stores and shop for women's wear, sleep dresses, beauty products, and much more. Consumers can utilize this card at the sister companies- PINK and Baby & Bath also. However, the shopping at sister companies you cannot earn shopping rewards. Victoria’s Secret is, undoubtedly, the best brand to shop for lingerie. Consumers can get appealing rewards and benefits there.