Introduction

Accounting is a set of rules that ensures that financial reports are accurate and consistent. Because of computerized accounting systems and the standardization of the accounting cycle, mathematical errors are less likely to occur. Most accounting software today automates the process, reducing the time and effort required by employees and the potential for human error. Financial statements are prepared and finalized during the accounting period, and the accounting cycle begins and ends.

Various factors influence and influence the length of an accounting period. In practice, the annual period is the most commonly used accounting period. Many transactions are recorded during the accounting cycle. Annual financial statements are typically prepared and legally mandated at the end of the year. Financial statements for public organizations must be provided by a specific date.

The Accounting Cycle Vs. The Budget Cycle

The accounting cycle differs from the budget cycle. As a result of the accounting cycle, all financial transactions are accurately recorded and remembered from previous occurrences. The budget cycle is concerned with making projections about how much money will be spent in the future. For the most part, it is used internally. As a result of this process, external customers are provided with helpful information about the company's finances.

A Comparison of the Accounting and the Operational Processes

The primary distinction between accounting and operational cycles is the focus. All financial transactions in a small-sized business, as well as a broader business focus, are covered by accounting cycles. The accounting and operating cycles have different start and finish times. The length of an operating cycle is influenced by the amount of inventory available for purchase. Accounts receivable and payable are more complicated than the operational cycle. The four stages of the operating cycle can be summarised as follows. The most significant difference is the small company's view of the accounting and operating cycles. An inventory's profits and costs can be valued using the operating cycle.

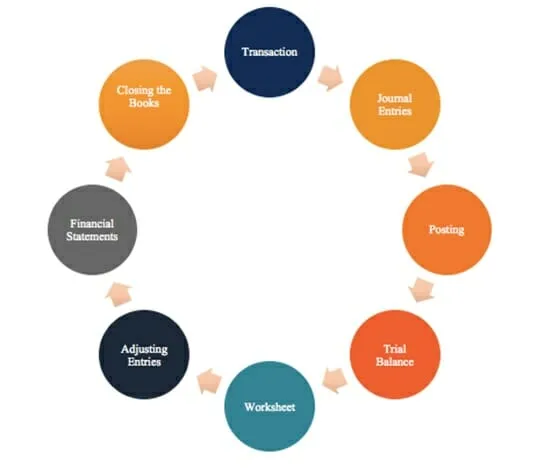

Accounting Process Steps

The occurrence of transactions marks the beginning of the process. There would be no transactions to keep track of if there were no financial exchanges to be made. The payment of a debt, the purchase or acquisition of goods, the revenue generated from sales, or the expenses incurred are all examples of these transactions. The next step is to record the transactions in chronological order in the company's journal after they have been properly organized. As long as debits and credits are transferred between two or more accounts, they should always equal each other.

In the general ledger, all of the transactions that have been posted to the GL Journal are available. At the end of each accounting cycle, a total balance is determined for the accounts. This total balance can be monthly, quarterly, or annually, depending on the business type. The bookkeeper should check for errors and adjust if the balance does not match credits and debits correctly. On the worksheet, these are noted. Accruals and deferrals should be recorded at the end of the accounting period to reflect the accruals and deferrals.

Statements of Financial Position

A balance chart, revenue statement, and cash flow statement can be generated using the correct balances. The revenue and expense accounts have been closed and zeroed out for the next accounting cycle. This is because revenue and expense are accounts on the income statement that reflect the performance at a specific time. Because a balance sheet account is only a snapshot of the company's current financial position, it cannot be closed.

To the Comptroller-General

A bookkeeper's and an accountant's eyes are on the general ledger. All financial transactions of a company can be viewed in this database. When you think about it, it's all the transactions recorded on a particular document and in accounting software. Check the general ledger to see how the company's cash balances have changed and the transactions that have occurred. It shows all of the money that has been credited and debited.

Accounts Payable and Accounts Receivable

A "transaction" is defined as "the process that involves conducting business" and refers to the act of purchasing or selling something. Transfers of goods, services, or money may be part of the process. Typically, a journal entry is used to document the completion of a transaction in the company's accounting system. To begin with, however, it must first be acknowledged. The following information is included in each journal entry:

- Amounts that will be withdrawn from the account(s).

- The accounts to be opened and the corresponding sums to be paid.

- When the transaction was scheduled

- A breakdown of the deal.

Conclusion

The fundamental accounting concepts must be understood to grasp the accounting process as a whole fully. When a company can report sales revenue, revenue recognition, the matching principle, and the accrual concept must all be understood.