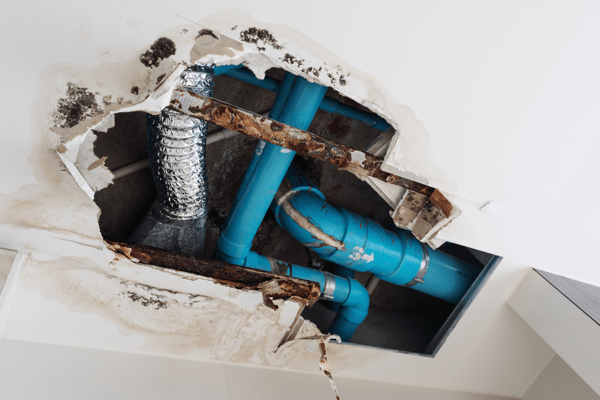

There's a big difference between slow leaks and burst pipes. The cold weather has caused a pipe to burst within your home, and water damage has been caused to your wood floors. Do homeowners insurance policies provide coverage for pipe replacement? It's dependent on the policy you have.

Homeowners' insurance can cover water damage; however, it is contingent upon the accident. If the damage is unexpected or unforeseeable, like a damaged pipe, leaky cooling unit, or a malfunctioning washing machine, then the policy normally will cover it.

Different Damages

If the cause of the issue is "gradual damage" happens over long time duration, as a result of leaky pipes like cracks in your house's foundation, the insurance company might be reluctant to cover it. It can be difficult to determine if homeowners insurance covers plumbing or not. Most insurance policies will not cover issues from wear and tear, as well as the gradual loss. However, there are certain exclusions. "Resulting damage," for instance, could be the result of a cracked water tank, exploding dishwasher, or a broken pipe.

How Insurance Views Pipes

Many insurance companies think that a homeowner maintains a house's plumbing normally. The property owner is accountable for ensuring that pipes do not freeze, remain free of obstruction, and are tightly screwed in and regularly maintained. It is also important to be alert for mold or mildew as well as other indications of water damage, which could indicate some small cracks, a hairline fracture, or a leak in one of the pipes.

The gradual damage from a slowly leaking or rusting pipe is usually not protected. However, leaky pipes differ from burst pipes or broken pipes. The gushers can flood your entire house. Therefore, the destruction and damage they cause are generally covered under the all-perils portion of the homeowner's insurance.

If you reside in a northern area and the broken pipe results from being frozen due to a lack of heat within your house, an insurance provider may cite negligence to decline the claim. Pipes that break must occur suddenly and without warning should not be preventable. If you fail to notice a leaky pipe, and then it ruptures, your insurance company could find evidence of a leak that has been present for a long time and reject the claim.

What Is Covered?

Certain policies differentiate between the damage that results from it and the damage that was initially caused. For instance, if the water damage resulting from a pipe or appliance failure is mentioned in the insurance policy's wording as being covered, you could be compensated for a portion or all the damage caused, even though they weren't immediately apparent.

If a pipe bursts, homeowners insurance will cover carpets, floors or drywall damage, paint, and other things. The services required to wash the mess, dry the property, and perhaps prevent mold from forming would be covered. The cost of repairing the pipe that has burst or replacing the damaged appliance, which is the cause of the problem, is not covered.

How To Avoid Having A Water Damage Claim Denied

It's essential that your plumbing is regularly examined by an accredited professional and keep documentation of repairs as well as people you've employed in the past to perform checks and repairs. These records can be very crucial in the event of the need to file a claim.

Different parts of your plumbing at home have different lifespans. Replace pipes that are past their expected service lifespans. In colder climates, keep the heating on in your home even if set to low during the winter, particularly when you're away for a prolonged duration. Each home, regardless of weather, should be equipped with a shutoff valve for water. Be aware of where the valve is situated and ensure that it's functional if you have to shut off the water immediately.

What To Do If Your Claim Is Denied

Suppose you've been denied coverage you believe could have covered the harm caused by a pipe leak. In that case, it is worth having a second opinion with an accredited professional or a consumer advocacy group well-versed in your area insurance coverage. The insurance company might have an ombudsman who can assist in reviewing your case. You may also reach out to your state insurance commissioner to get assistance or to make an insurance complaint.