Introduction

Everything from necessities like food and clothing to luxuries like jewelry and electronics may be found in the consumer goods industry. While total food consumption is not expected to fluctuate radically, individuals' spending on more discretionary products like cars and electronics varies greatly based on several economic factors. Demand for consumer products is very sensitive to changes in the labor market, wage growth, price stability, interest rates, and consumer optimism.

Strategic Consumer Spending

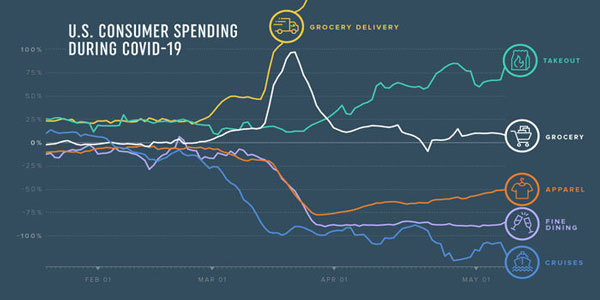

Consumers worldwide are still investing money in groceries and other home essentials and, in some cases, are even increasing their outlays from before the outbreak. Consumers in nearly all nations questioned plans to boost their spending on at-home entertainment due to shifts in their media consumption patterns. This is especially true in Korea, a nation with already robust gaming culture.

The Effect of the Invisible Hand

The market's "invisible hand" works partly because consumers benefit from it in many ways. Competition for limited resources provides consumers with information on the types and quantities of goods and services they should be offered. The combined wants, preferences, and spending of consumers ultimately lead to lower prices, higher quality, and greater quantities of goods and services, all else equal.

How Consumer Spending Is Measured

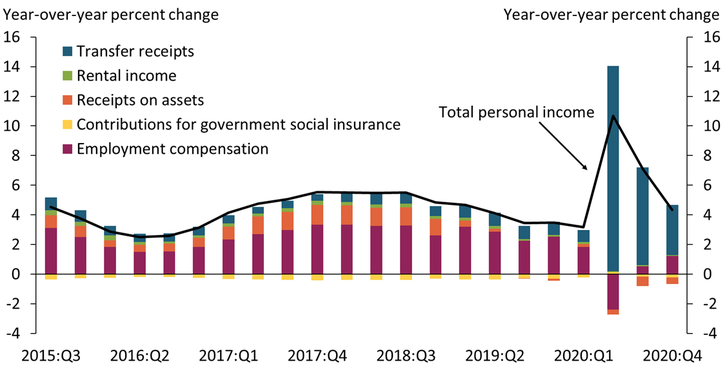

Consumer spending, or personal consumption expenditures (PCE) as defined by the Bureau of Economic Analysis (BEA), is the value of goods and services purchased by or on behalf of persons (households and nonprofit institutions servicing households) in the United States. Personal Consumption Expenditures (PCE) account for about two-thirds of GDP and are a significant contributor to GDP growth in the short run.

In 2021 and 2022, consumer expenditure is predicted to increase rapidly. As vaccination rates rise, the country may return to pre-pandemic levels of calm by the year's end. After more than a year of fighting the virus, businesses focusing on serving consumers are finally starting to recover, which is good news for the job market. Since April 2020, when employment fell by 14.3%, the labor market has been steadily improving, adding an average of 1,000 new positions every month.

Even though employment in May was 4.5% lower than a month before the pandemic occurred in February 2020, the economy is predicted to gain speed. The job market will continue to benefit as it tries to inch back toward pre-pandemic levels. As the economy and people's health continue to improve, many individuals may have sizable savings they can put to use. Consumers, by our estimation, put away around US$1.6 trillion more than they would have in the absence of the epidemic.

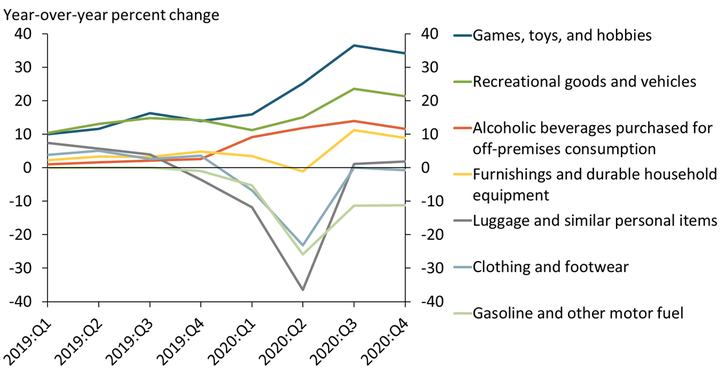

Changing Spending Patterns

From 1947 to 2000, durable goods maintained almost the same percentage of total consumer spending. The household income spent on durable goods has varied relatively little, staying between eleven and sixteen percent. However, expenditure on nondurable goods and services has shifted relative importance. In 1947, services accounted for less than a third of consumer spending; by 2000, they accounted for more than half. The decrease in the proportion of income going toward the purchase of nondurable products (from 56 percent to 30 percent) made this gain possible.

Since the late 1950s, the automotive industry and its components have exhibited a clear cyclical pattern, even among durable goods. However, most change can be found between the bottom and top 5% of consumer purchasing. The home furnishings and appliances market show a minor decreasing tendency and cyclicality.

Unemployment and inflation are at all-time highs throughout the region. Some of the fastest inflation rates in recent history are recorded in Latin America, with Brazil seeing a 26-year high in April and Mexico struggling with rates not seen since 2001. The IMF predicts that the unemployment rate in Latin America will reach 8.6 percent in April 2022. (IMF). Which is rough twice the rate considered optimal for a thriving economy.

Inflation is outpacing household income. According to our "Latin America Ecommerce Consumer Study 2022" poll, conducted in March 2022, over a quarter of digital buyers in Latin America reported a decline in household income of more than 10% during the preceding 12 months. Most of these declines were seen in socially and economically vulnerable groups, particularly women and lower-income people.

Conclusion

Consumer spending is just one area where the effects of COVID-19 have been felt. Consumer spending drops across the board when restaurants and stores are closed, and air travel is halted due to lockdown measures. Similarly, the coronavirus pandemic's economic repercussions have dampened consumer spending, and many people anticipate more declines in their household income in the months ahead. Spending more money on home entertainment and groceries is one downside of staying inside.