Introduction

Few would admit they look forward to creating a budget, but that shouldn't diminish its significance. To avoid becoming broke, it's a good idea to create a budget that helps you anticipate your future outlays and sheds light on your current spending patterns. It's possible that in today's climate of high inflation, many people are finding it difficult to meet their monthly financial obligations while also making savings goals. Setting up a budget will help you get by and relieve some of the stress of worrying about how to pay for anticipated bills, but it won't do anything to stop inflation.

Calculate Your Net Income

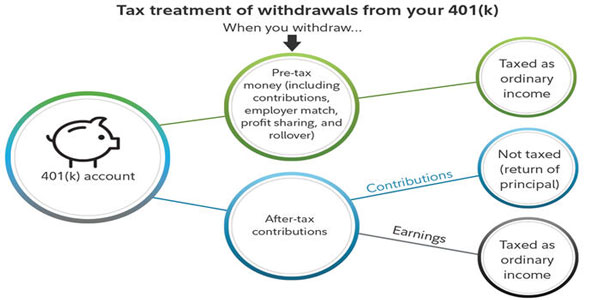

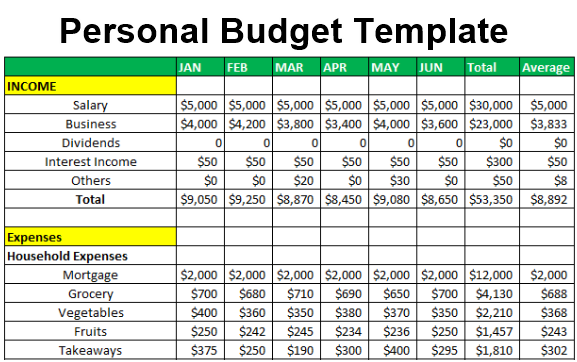

Your monthly net income should serve as the basis for your budget. In other words, it's the amount of money you get to keep after all taxes and employer-sponsored benefits like health insurance and retirement plans have been subtracted. Overspending is possible if you mistake your gross pay for your net income and use the latter as a basis for your budgeting decisions. Keep careful records of your contracts and payments if you are a freelancer, gig worker, contractor, or self-employed person to manage your inconsistent income better.

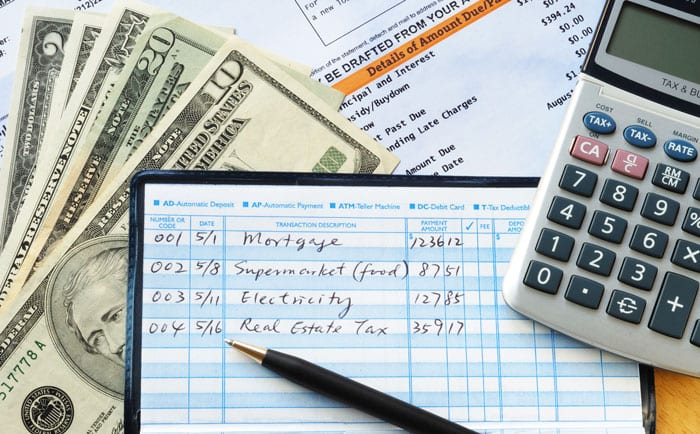

Track Your Spending

Knowing your income is the first step in determining your expenditures. Finding out where your money is going and what you can cut back on is much simpler if you keep track of your spending in several categories. To start, tally up all of your regular outlays. Monthly expenses include rent or mortgage, utilities, and car payments. Then, make a separate list for your "variable" costs, which can shift from month to month and include things like food, transportation, and entertainment. There may be savings to be had here. Credit card and bank statements might be an excellent starting point, as they often detail and classify your monthly spending.

Put Your Budget Plan into Action

Congratulations, you have completed the budgeting process! At this point, action is the most crucial aspect of any strategy. The question to ponder is: Have I provided for my necessities (clothing, shelter, food, transportation, etc.)? Do I have enough money to pay off my debts, cover emergency costs, save for the future, and enjoy myself? It's possible that once you put your budget into practice, you'll find some adjustments necessary. What you've said is acceptable. Adjust the budget as necessary so that it supports your needs and ambitions. To do this, you may want to reevaluate your spending habits, realign your priorities, reconsider your long-term financial goals, or examine the difference between your needs and wants. Let your budget develop alongside you, and experience the thrill of making genuine progress towards your financial goals!

Think About Your Financial Priorities

After keeping track of your expenditures, you should evaluate how your past habits compare to your current goals. Rent, groceries, and utility costs are just some examples of mandatory outlays that affect everyone. It's easy to blow over your budget on frivolous purchases if you don't make an effort to monitor your spending. You could be surprised to learn, for instance, that you're spending hundreds of dollars every month on takeout or that you have a slew of unused subscription services.

Seek a Raise from Your Current Employer

This may take less time than actively seeking a new position, but it may feel much more daunting. Employers are not obligated to compensate you based on your value to the company (the money you bring in, either directly or through other means), and they certainly cannot pay you more than you're worth. If your employer compensated you more than you contributed to the company, that company would soon be joining the ranks of defunct enterprises. Despite this, you may discover, after doing some digging, that your salary falls in the lower half of the typical range for people holding your occupation.

Label Fixed and Variable Expenses

When you've tallied up your monthly outlays, note which ones are recurring and which are subject to change. Rent, food, transportation, insurance, and debt payments are all examples of fixed expenses. Expenses like a gym subscription or eating out are variable costs that can be adjusted on the fly. If money is tight, you might have to cut back on your gym membership and restaurant visits, but you will almost always have to pay your rent or mortgage.

Conclusion

Maintaining a simple household budget is the first step in responsible financial planning. Making a budget helps you save money and shows you where your money goes every month. Maintaining control of your finances and progressing toward your goals is much simpler with a well-established household budget. The following are some easy measures that can be taken to establish and keep a household budget.